Advanced mortgage calculator with extra payments

And with the house move came a brand new mortgage. If you start making extra payments in the middle of your loan then enter the current loan balance when you started making extra payments and set the loan term for however long you have left in the loan.

Advanced Mortgage Calculator With Extra Payments Make Additional Weekly Monthly Biweekly Yearly And Or One Time Home Loan Payments

Conventional FHA Loan VA Loan.

. Divide the breakeven timeframe months by 12 to calculate the number of years you need to make payments on the loan before realizing any savings from the refinance. For example if you want to make an extra monthly payment of 100 during months 1-9 and an extra payment of 400 for months 7-36 you enter 100 for months 1-6. Since a bi-weekly plan results in 13 annual payments making that extra 13th payment can trigger the penalty.

Even just an extra payment of 20 per month can make a. No matter your needs and the type of mortgage loan the precise and thorough calculations done by our advanced mortgage calculator can save you from a. It includes advanced features like amortization tables and the ability to calculate a loan including property taxes homeowners insurance property mortgage insurance.

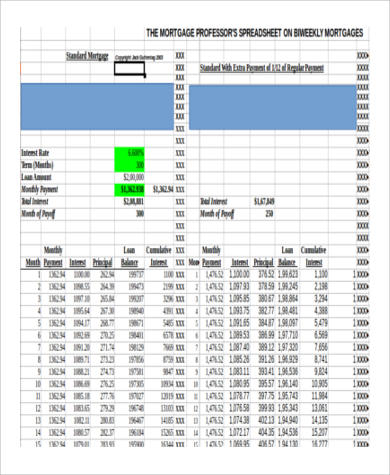

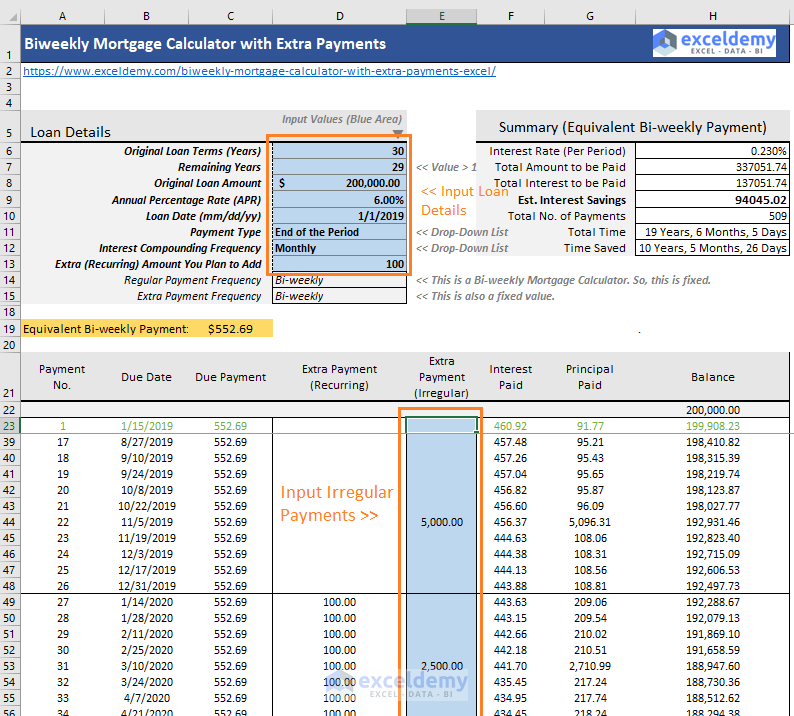

Advantages Disadvantages of Biweekly Payments. A mortgage calculator is a smart first step to buying a home because it breaks down a home loan into monthly house payments based on a propertys price current interest rates and other factors. Biweekly Mortgage Calculator with Extra Payments.

Generally speaking points are not a great deal if you plan to sell the home soon but if you plan to live on the home for many years or perhaps throughout the duration of the loan buying points can save you money. 30-Year Mortgages and Extra Payments. Extra Payments In The Middle of The Loan Term.

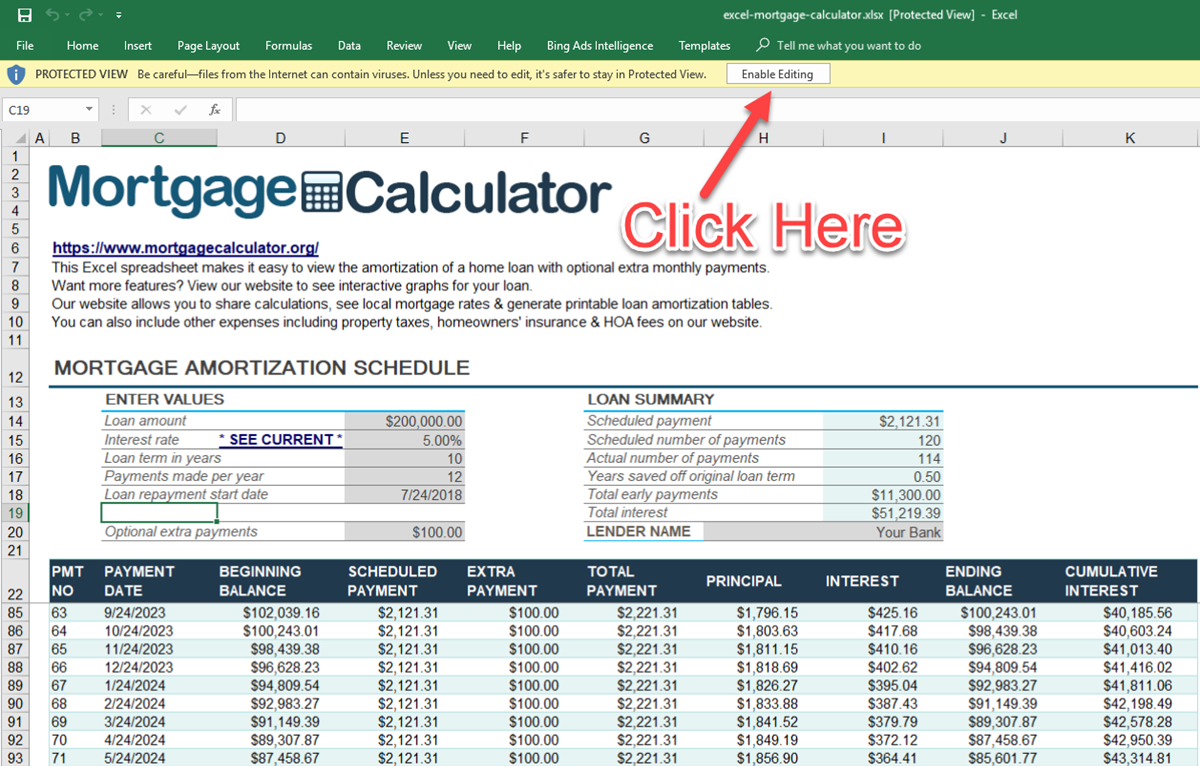

Use a mortgage refinance calculator to determine the breakeven point which is the number of months it takes for the savings to outweigh the cost of refinancing. This free mortgage calculator helps you estimate your monthly payment with the principal and interest components property taxes PMI homeowners insurance and HOA fees. Free mortgage payoff calculator to evaluate options to pay off a mortgage earlier such as extra payments bi-weekly payments or paying back altogether.

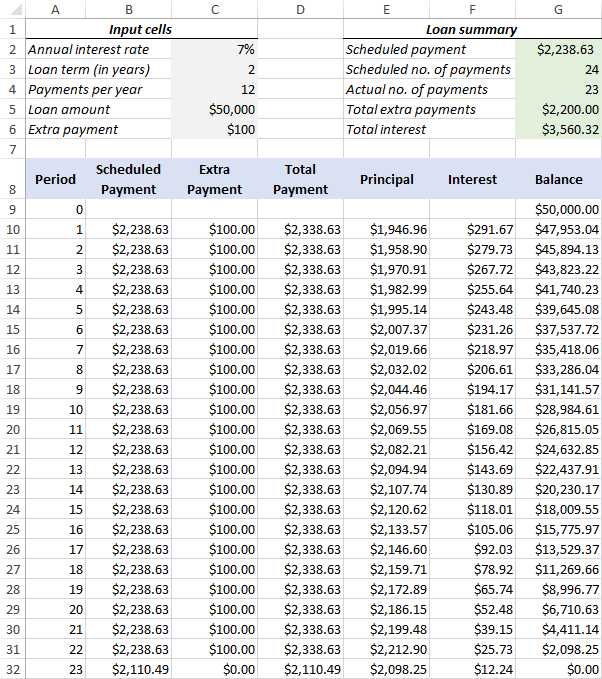

Recently we moved houses. The monthly vs biweekly mortgage calculator will find out how much faster you can pay off your mortgage with biweekly payments and how much. Mortgage Calculator Excel spreadsheet is an advanced mortgage calculator with PMI taxes and insurance monthly and bi-weekly payments and multiple extra payments options to calculate your mortgage payments.

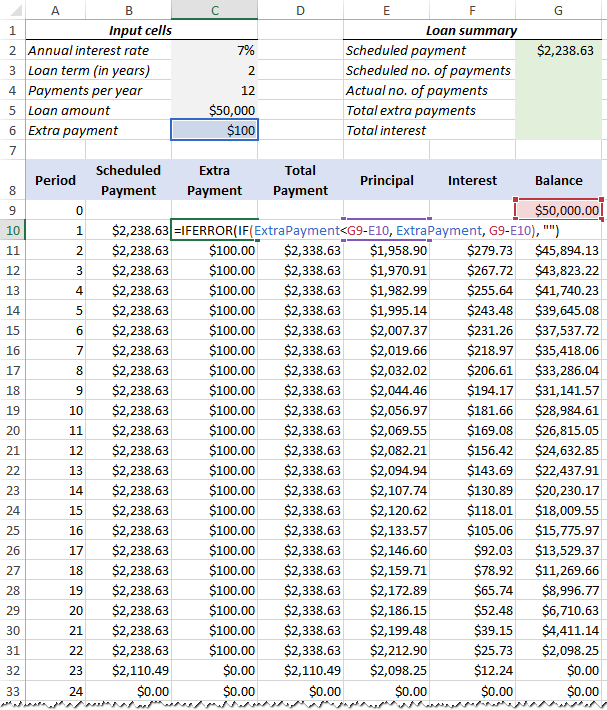

The calculator lets you determine monthly mortgage payments find out how your monthly yearly or one-time pre-payments influence the loan term and the interest paid over the life of the loan and see complete amortization schedules. The calculator will not recognize overlapping payments of the same frequency. Extra payments count even after 5 or 7 years into the loan term.

The CUMIPMT function requires the Analysis. Home financial mortgage payoff calculator. How to Use the Mortgage Calculator.

Using our mortgage rate calculator with PMI taxes and insurance. Ultimately significant principal reduction cuts years off your mortgage term. By making additional monthly payments you will be able to repay your loan much more quickly.

Expensive penalty charges can dwarf any savings you make from bi-weekly payments. The mortgage calculator spreadsheet has a mortgage amortization schedule that is printable and exportable to excel and pdf. Use this calculator to compare the full cost of a loan with discount points to one without them.

Since creating this spreadsheet Ive created many other calculators that let you include extra mortgage paymentsThe most advanced and flexible one is my Home Mortgage Calculator. Advanced Option ARM Calculator with Minimum Payment Change Cap. But as a self-employed person with variable income I find the steady nature of mortgage payments little hard to digest.

Be sure to check with your home lender to make sure you can make extra payments on your mortgage without. Taking a reverse mortgage is a popular financial strategy that helps generate more income during retirement. It also calculates the sum total of all payments including one-time down payment total PITI amount and total HOA fees during the entire amortization.

Computes minimum interest-only and fully amortizing 30- 15- and 40-year payments. Especially with rates even the most minute change can have a big impact on your estimated mortgage payments. This free online mortgage amortization calculator with extra payments will calculate the time and interest you will save if you make multiple one-time lump-sum weekly quarterly monthly andor annual extra payments on your house loan.

If the first few years have passed its still better to keep making extra payments. Calculate the difference in total interest paid on a mortgage loan when making additional monthly payments. A Roth IRA or a 401k before making extra mortgage payments.

You can still boost your mortgage even if you make extra payments after a couple of years on your mortgage. Also this calculator has the ability to add an extra amount extra payment to the monthly mortgage and turbo charge your interest savings. In addition to making extra payments another great way to save money is to lock-in historically low interest rates.

With this unique 4 column format you can compare scenarios side-by-side print amortization schedules and plan your payoff strategy. Extra payments per year. Mortgage Payments on Adjustable-Rate Mortgages Without Negative Amortization.

While people might find it confusing this is not at all a second mortgage which requires monthly payments. Instead a reverse mortgage is the opposite of a traditional mortgage. After the COVID-19 crisis the FOMC dropped the Fed Funds Rate to zero and issued forward guidance suggesting they would not lift rates through 2023.

For example if you are 35 years into a 30-year home loan you would set the loan term to 265. A fast and simple mortgage payment calculator online web app that gives you data fast easy. Most homebuyers in America tend to obtain 30-year fixed-rate mortgagesAs of June 2020 the Urban Institute reports that 30-year fixed-rate loans account for 77 percent of new mortgages in the market.

Another technique is to make mortgage payments every two weeks. For Excel 2003. Mortgage Payoff Calculator - by setting the desired payoff date monthly payment or remaining term with optional extra payments you can easily compare different repayment scenarios.

Mortgage Amortization Calculator - a simple tool that focuses on the amortization schedule of your mortgage. For your convenience current Redmond mortgage rates are published underneath the calculator to help you make accurate calculations reflecting current market conditions. Biweekly mortgage calculator with extra payments excel to calculate your mortgage payments and get an amortization schedule in excel xlsx xls or pdf format.

2020 has been a record year for mortgage originations as many homeowners refinanced to take advance of low. Its popularity is due to low monthly payments and upfront costs. The free mortgage calculator is a versatile tool as useful to an individual casually researching properties as it is to someone on the cusp of making a purchase.

By using an advanced calculator you can see the savings in a matter of seconds and persuade yourself to bite the bullet and pay more every time you receive your car or mortgage loan statement. It usually comes in a line of credit paid to you by a lender. Unfortunately I couldnt find such a calculator.

This way they not only may enjoy higher returns but also benefit from. So I wanted to know what impact it would have on my mortgage if I make arbitrary extra payments.

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Mortgage With Extra Payments Calculator

Free 6 Mortgage Payment Calculator Extra Payments In Excel Pdf

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Free 6 Mortgage Payment Calculator Extra Payments In Excel Pdf

Extra Payment Calculator Is It The Right Thing To Do

Loan Amortization With Extra Principal Payments Using Microsoft Excel Tvmcalcs Com

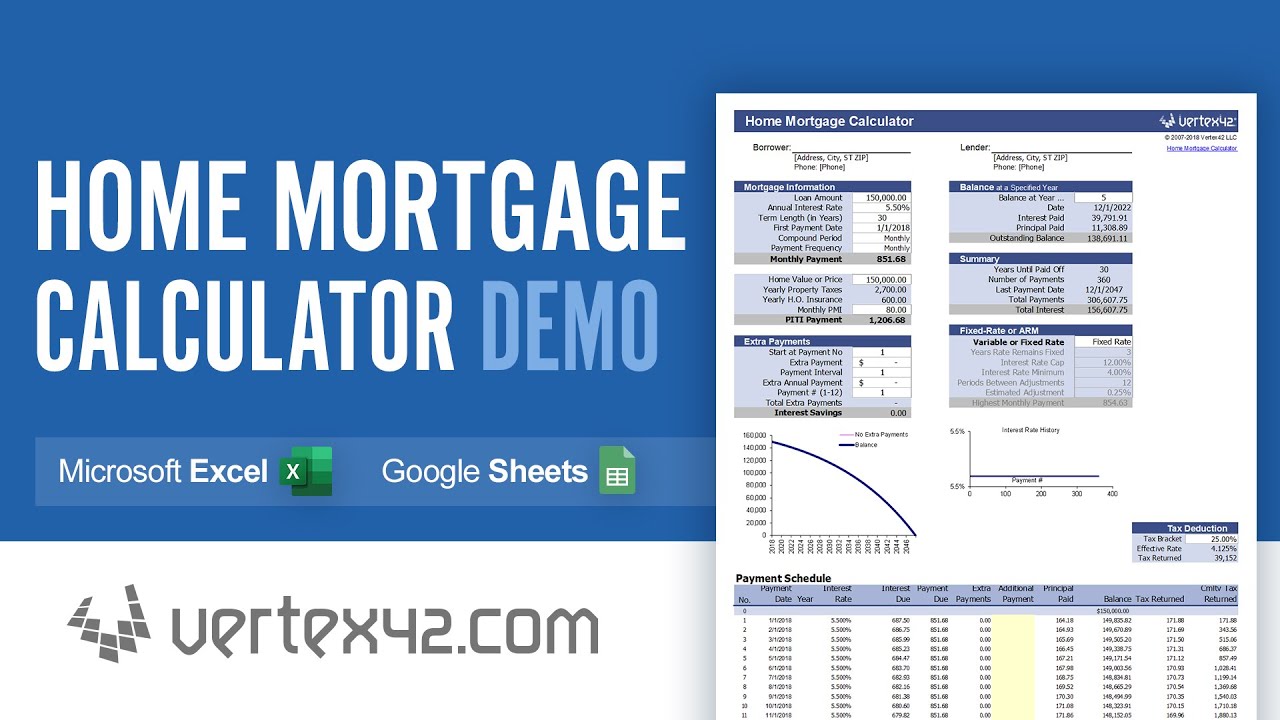

Home Mortgage Calculator Demo Youtube

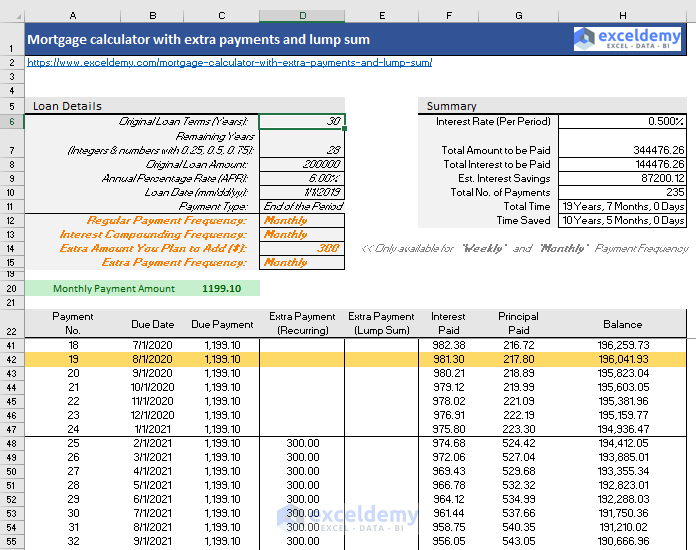

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Advanced Mortgage Calculator With Extra Payments Make Additional Weekly Monthly Biweekly Yearly And Or One Time Home Loan Payments

Free 6 Mortgage Payment Calculator Extra Payments In Excel Pdf

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortization Schedule Template With Extra Payments

Mortgage Payoff Calculator With Line Of Credit

Advanced Mortgage Calculator With Extra Payments Make Additional Weekly Monthly Biweekly Yearly And Or One Time Home Loan Payments

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Extra Payment Mortgage Calculator For Excel